Construction Heavy Equipment Financing

As little as 2% of the amount financed due at closing. Strong and average credit customers may qualify for only the first payment and processing fee due before obtaining equipment.

- One page application required for approvals up to $350,000

- Flexible terms and structures

- Apply online, electronically, by phone or fax. We will accept a standard credit application or provide our application

- Start-up businesses and challenged credit may also be approved for our other financing programs

Construction Equipment and Yellow Iron we routinely finance:

- Backhoe

- Bulldozers

- Chippers

- Compactors

- Drill Rigs

- Excavators

- Lift Equipment

- Motor Graders

- Motor Scrapers

- Piggyback Forklifts

- Rough Terrain Forklifts

- Skid Steer Loaders

- Wheel Loaders

- Water Wagons

- Cranes*

- Forestry & Logging*

- Paving & Curbing*

- Titles Vehicles & Trailers*

For credit approvals up to $350,000 simply provide the following information:

Personal guarantor(s) (account for 100% if ownership)

- Full legal name, home phone number

- Social Security Number

- Lessee’s signature (for paper applications)

Business

- Local phone number, fax number, FEIN and physical address

- Date of incorporation or date started

- Business type (proprietorship, corporation, LLC etc.)

Equipment (list information for each piece of equipment)

- Quantity and price

- Year, make, model and serial number

- Equipment seller’s business name, contact name, address and phone number)

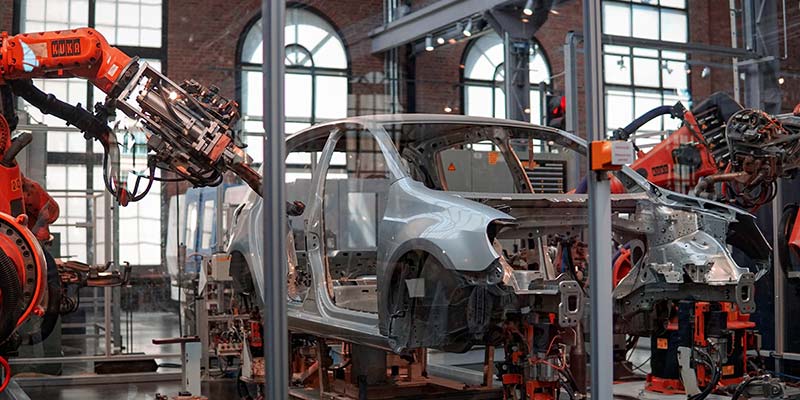

Manufacturing Equipment Financing

Acceptance delivers a wide assortment of financial solutions to a broad range of markets.

- No additional collateral

- Payments fixed for the term

- Possible tax benefits

- Multiple equipment schedules from different vendors available

- Simplify record keeping

- We do seasonal payment plans - new and used equipment

A few of our programs include:

- Step payments - start off lower then step up in fixed increments

- Seasonal payments - take any 3 months of the year off

- Delayed payments - payments start 60-90 days after the equipment is delivered.

Fleet Equipment Financing

From delivery trucks to over the road tractors. Minimum Fleet Size of Five (5) Truck Program

Minimum time in business, 5 years

All Acceptance Leasing regular programs apply in this category. The benefits of using us to finance your transportation needs include:

- No mileage restriction

- No condition requirements of return under our leasing program

- No money down required on loan or lease

- Low fixed rates for qualified applicants

- Can accommodate fleet purchases to multiple locations and billing under our contract

TRAC Lease Available

- No mileage limitations on any lease

- No condition limitations on any lease

- Customers must keep liability and collision insurance at all times

- First and last payment, one time documentation fee and title processing fee

- Ultra low monthly payments

TRAC Lease End

- 1. Purchase Vehicle for 20% of the original funded amount at lease end

- 2. Turn vehicle into a designated location

- (a) Vehicle is sold at auction. If amount received is 20% or more of the original amount funded (purchase price), customer is refunded the difference.

- (b) If amount received is less than 20% of the original amount funded (purchase price), customer is billed for the difference.

Owner Operator-1 Truck Program

For owner operators we offer plans which could be your most cost effective option. If you currently own your truck and have for the previous 3 years, here is what we can offer:

- No money down

- Low fixed payments

- No additional collateral

- No mileage restriction

Municipal Equipment Financing

Municipal equipment leasing offers several advantages over alternative methods of financing. First and foremost is simplicity. Under most state statutes, municipal contracts with terms of over one year require significant investments in time and money to comply with municipal debt restrictions. A Municipal lease is, in effect, a year-to-year obligation; therefore, many of these restrictions do not apply. Although a Municipal Lease has terms from 12 to 60 months typically, termination for non-appropriation distinguishes a Municipal Lease from all other types of leases. The obligation to pay is subject to appropriation being made annually over the term set forth in the lease.

Another major advantage is economy. Municipal Leases are most often the least expensive method of financing equipment. The slight interest rate advantage offered by a municipal bond is off set by the legal and administrative costs incurred in generating the bond issue. A Municipal Lease does not require separate legal or underwriting fees that the municipality would incur with a bond issue.

Municipal leases are governed by the Internal Revenue Code. Under these requirements, a qualified state or local Government Agency or governmental subdivision can finance property acquisitions under contracts in which the interest income the leasing company derives, will be exempt from Federal Income Tax. The IRS requires these transactions be: 1. A lease to own plans, (installment purchase); 2. For equipment that is essential to the government function; and 3. The contract can not have a significant residual or balloon payment at the end of the contract term. This tax exemption to the leasing company typically means lower interest rates than commercial equipment leasing.

Acceptance Leasing and Financing Service, Inc. provides Municipal Leasing solutions to municipalities across the country, through a network of underwriters. Please contact us regarding any questions you may have regarding this as an option for acquiring necessary equipment.

Medical Equipment Financing

- Minimum transaction is $15,000

- Startup practice accepted up to $75,000

- Acceptable equipment related to the practice and medical equipment related to the practice

- Complete application

- Special application only programs up to $200,000

Technology Hardware & Software Financing

How cost effective would it be if you could use your technology equipment for up to 5 years then decide if you want to purchase or invest in new?

With our leasing program you do exactly that, and possibly save on taxes also. Just tell us you want "options" at the end of the term and we will structure it for you. We also make upgrading your equipment easy with our Master program, just ask us how.

Also we can finance just software for up to 36 months. Just tell us "Software Only".

So whether you wish to make the purchase decision now or later we can help with all your technology needs. The equipment's we specialize in are Point of Sale, Telephone, computer networks.